On 1 April, 2025, the IRD made a change that might impact how much tax you need to pay on your investments.

As a member of a KiwiSaver Scheme or as an investor in a managed fund, you will be paying tax on your investment returns based on your Prescribed Investor Rate (PIR). This tax is automatically deducted on your behakf each year.

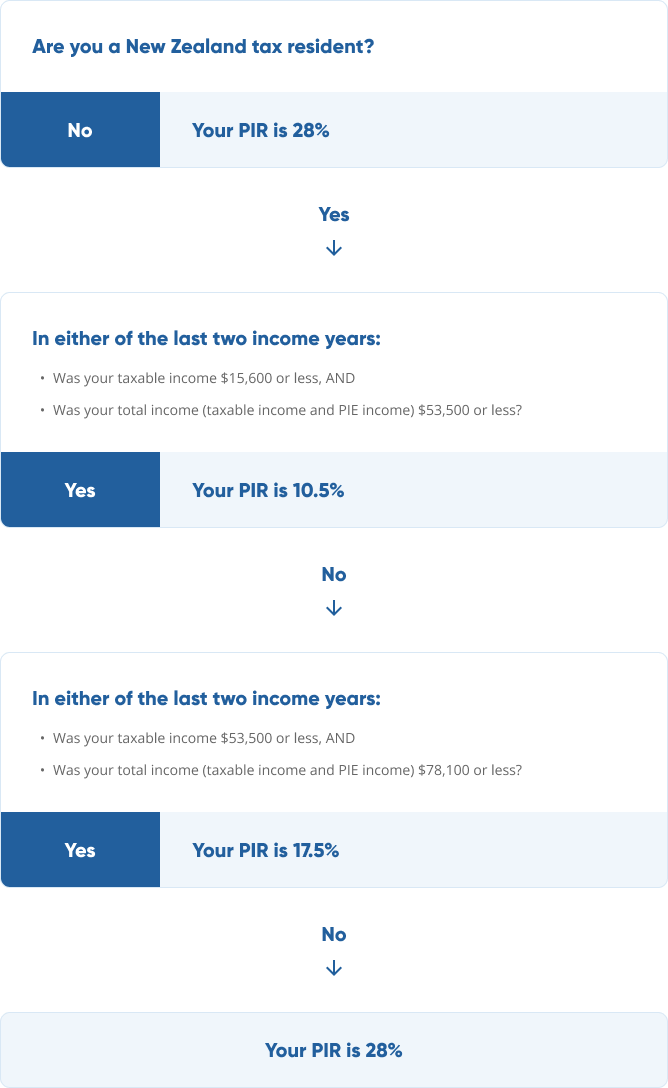

Your PIR is based on your income over the last two tax years and will be either 10.5%, 17.5% or 28%.

The three PIR taxable income thresholds have now changed from $14,000, $48,000 and $70,000 to $15,600, $53,500 and $78,100.

That means it’s possible you may now qualify for a lower PIR. For example, if your taxable income is $50,000 and your total income is less than $78,100 (from the last two tax years), under the previous rules your PIR would have been 28% but under the new rules it will be 17.5%.

This is likely only the case for a small group who fall in the gap between the old and the new thresholds, but it’s definitely worth checking!

Follow this table to work out your PIR:

If you need to update your PIR for your Generate KiwiSaver or Generate Managed Fund account, the easiest way to do it is via our Generate app (or by logging in online). Simply go to My Profile and edit the rate there.

PLEASE NOTE:

Generally you are a New Zealand tax resident if:

- You are in New Zealand for more than 183 days in any 12-month period;

- You have a “permanent place of abode” in New Zealand; or

- You are away from New Zealand working for the New Zealand Government.

Previous two income years refers to the two years prior to the tax year that the PIR is being applied to. (For example, use your income for the 2023 and 2024 tax years to work out your 2025 PIR.). Your attributed PIE income or attributed PIE loss for an income year is the amount of income or loss attributed to you by PIEs in that income year, which will be recorded in the tax certificates issued to you at the end of the income year by each PIE you invest in.