Did you know your humble KiwiSaver account could have the potential to earn you some big money wins? It’s probably not something you’ve thought much about, but it’s a lot simpler than it seems.

We’ve picked our top 4 KiwiSaver hacks to help you make the most of your investment.

Don’t stress that you didn’t know these sooner – now is the next best time to get your KiwiSaver account sorted for 2025!

If you want a sneak peek before you read this entire article, here's the summary:

1. Don't stall in a default fund.

2. Understand that small amounts make a big difference.

3. Focus on net returns, not fees.

4. Get expert advice.

Read on to see how these 4 simple hacks can help you level up your financial future.

1. Don’t stall in a ‘default’ fund – the right fund can kick your KiwiSaver savings into top gear.

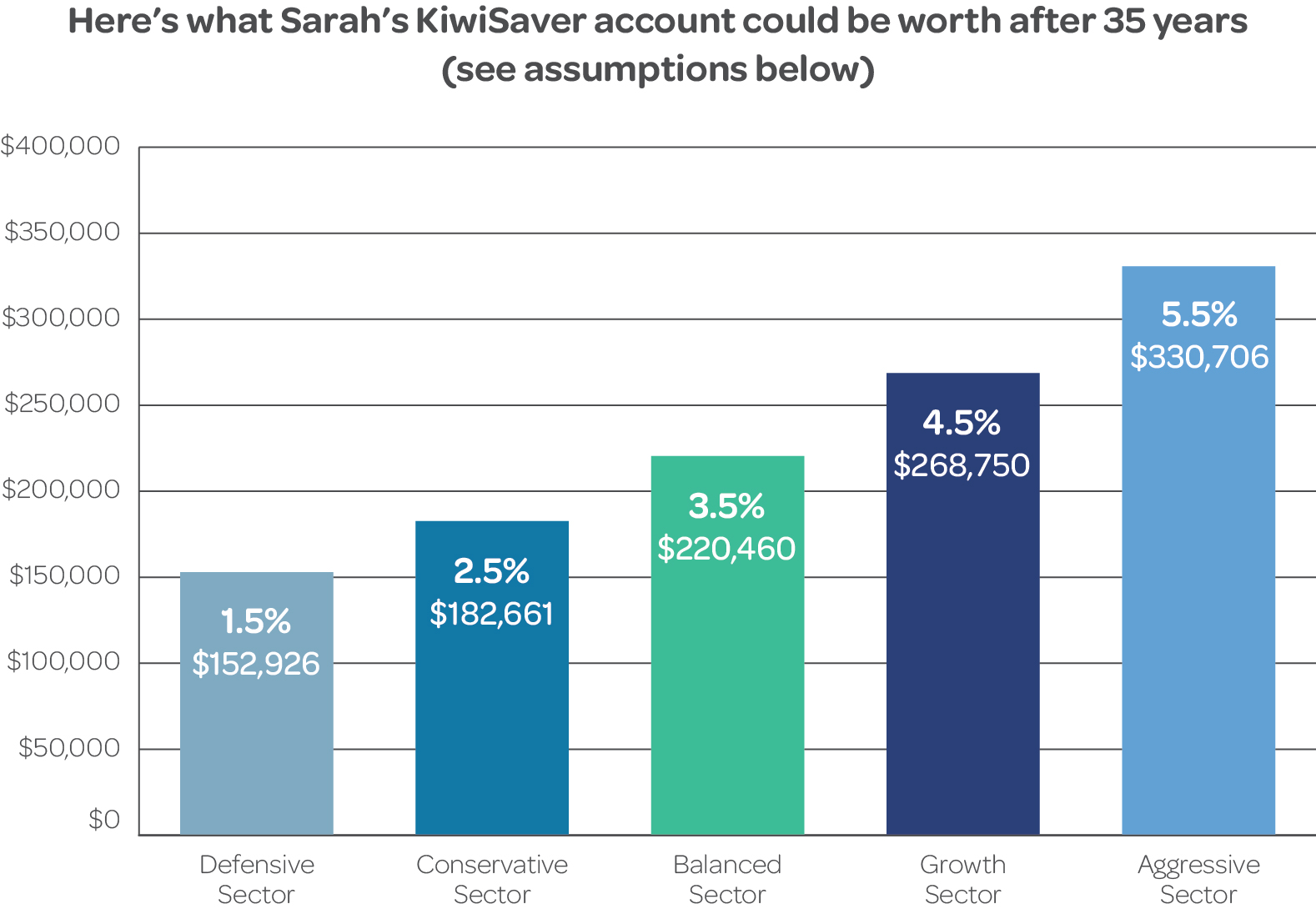

Wow! Just look at the big difference the type of fund can make to how much your KiwiSaver balance may be worth at retirement. In this example, Sarah is contributing the same amount of money, with more than double the final result, when choosing an aggressive fund.

Assumptions

Sarah is aged 30 on a salary of $55,000 p.a. and already has a KiwiSaver balance of $20,000. She remains employed and contributing 3% of her before-tax pay until she reaches retirement at age 65. She continues to receive the full Government contribution each year. In her first year on $55,000 her 3% contributions will work out to $32p.w. Her salary is assumed to grow by 3.5% p.a. Inflation is assumed to average 2% p.a. Her employer’s contributions are net of employer superannuation contribution tax.

The returns are used for illustrative purposes only and do not reflect the prospective performance of the Generate KiwiSaver Scheme or of any fund. They include tax of 28% (the highest and most common tax rate for KiwiSaver members) and average fees for the relevant sector. The returns are subject to investment and other risks (including potential losses). No returns are guaranteed or assured, and returns can at times be negative, particularly given the length of the investment period shown in the illustration. Past performance is not necessarily an indicator of future performance and returns over different periods may differ.

If you signed up to KiwiSaver a while ago, you might not even remember which Scheme provider and what type of fund you are in. But if you didn’t specify a particular provider and fund, you’d have been allocated into one of six default KiwiSaver funds.

It’s a common issue - almost half of all new members start their KiwiSaver savings journey in a default fund. While there is nothing inherently wrong with them, default funds are intended to be a ‘parking space’ until you decide which provider and fund suits you best.

Default funds are all ‘balanced’ funds – about halfway between a conservative fund and a growth fund. The potential for returns is typically moderate in a default fund - they assume less risk, but are a bit like being in the slow lane.

At first glance, you might assume that higher risk is best avoided. But, depending on your investment timeframe, an aggressive or growth fund has the highest potential for gains. Because KiwiSaver is mainly a long-term investment, the ups and downs of the market are smoothed out over time, so risk is reduced. For someone joining KiwiSaver at 25 and not intending to withdraw until 65, an aggressive or growth fund would offer the best potential for returns, as you saw from the graph above. But there would be ups and downs along the way.

NOTE: An exception might be if you are planning to use some of your KiwiSaver balance for a first-home withdrawal. In that case, your investment timeframe will be shorter, and a growth fund may not be the best choice. However, once you have made your first home withdrawal, it’s usually a good idea to get into a growth fund for the rest of your KiwiSaver savings journey.

TO DO

✔ One of the best ways to figure out if you’re in the right fund is to have a no-obligation chat with a Generate KiwiSaver Scheme adviser. They can help you work out your risk tolerance and even show you different projections of how much your account could be worth, using different fund types as examples.

✔ You can also have a go using our handy calculator here, and get instant results! Check it out and see what a difference your fund type can make.

2. Don’t underestimate the difference small amounts can make to your KiwiSaver savings balance – add a bit more to gain a lot more.

You might be thinking, ‘What does a percentage point even matter?’ How can a few dollars here and there make a difference? But because KiwiSaver is primarily a long-term investment, even small amounts make a big difference.

This is all thanks to the power of compounding returns. Your principal (the money you invest) earns returns, and these returns are reinvested. Over time, you earn returns on the returns, as well as on the principal. The more time your money is invested, the more potential you have to earn compounding returns.

Take a look at this graph to see what a difference compounding returns can make over time.

These simulated results show the positive effects of compounding returns for three investors in an aggressive fund:

Investor A starts saving at age 20, with a starting salary of $35,000.

Investor B starts saving at age 30, with a starting salary of $45,000.

Investor C starts saving at age 40, with a starting salary of $55,000.

Assumptions: Each investor has a starting balance of $20,000. Each investor remains employed at all times until their retirement at age 65. No withdrawals are made. Their salaries grow by 3.5% per annum, and they earn a 5.5% per annum return after taxes and fees. Each investor continues to receive the full government contribution. Each investor is invested in an aggressive fund. Inflation is assumed to average 2% per annum. The investors and their employers each contribute 3% of the investor's before-tax pay into the investor's KiwiSaver account. The employer's contributions are net of employer's superannuation tax at current rates. Balances are expressed in real terms as a current dollar amount.

Disclaimer: This illustration used assumptions provided by the Government intended to illustrate the benefits of investing early. The illustration above does not reflect the prospective performance of the Scheme or any fund. Returns to members of the Scheme are subject to investment and other risks (including potential losses). No returns are guaranteed or assured, and returns at times can be negative, particularly given the length of the investment period shown in the illustration. Past performance is not necessarily an indicator of future performance and returns over different periods may differ.

TO DO

✔ Use our handy calculator here, and see how much of a difference it could make if you increase your contribution rate by 1%, 2% or more.

✔ A great tip is to increase your contribution rate when your pay goes up, when you score a promotion or new job. Instead of just spending to match your new income level, pay yourself first and get your money working for you. Then you maximise those compounding returns even more!

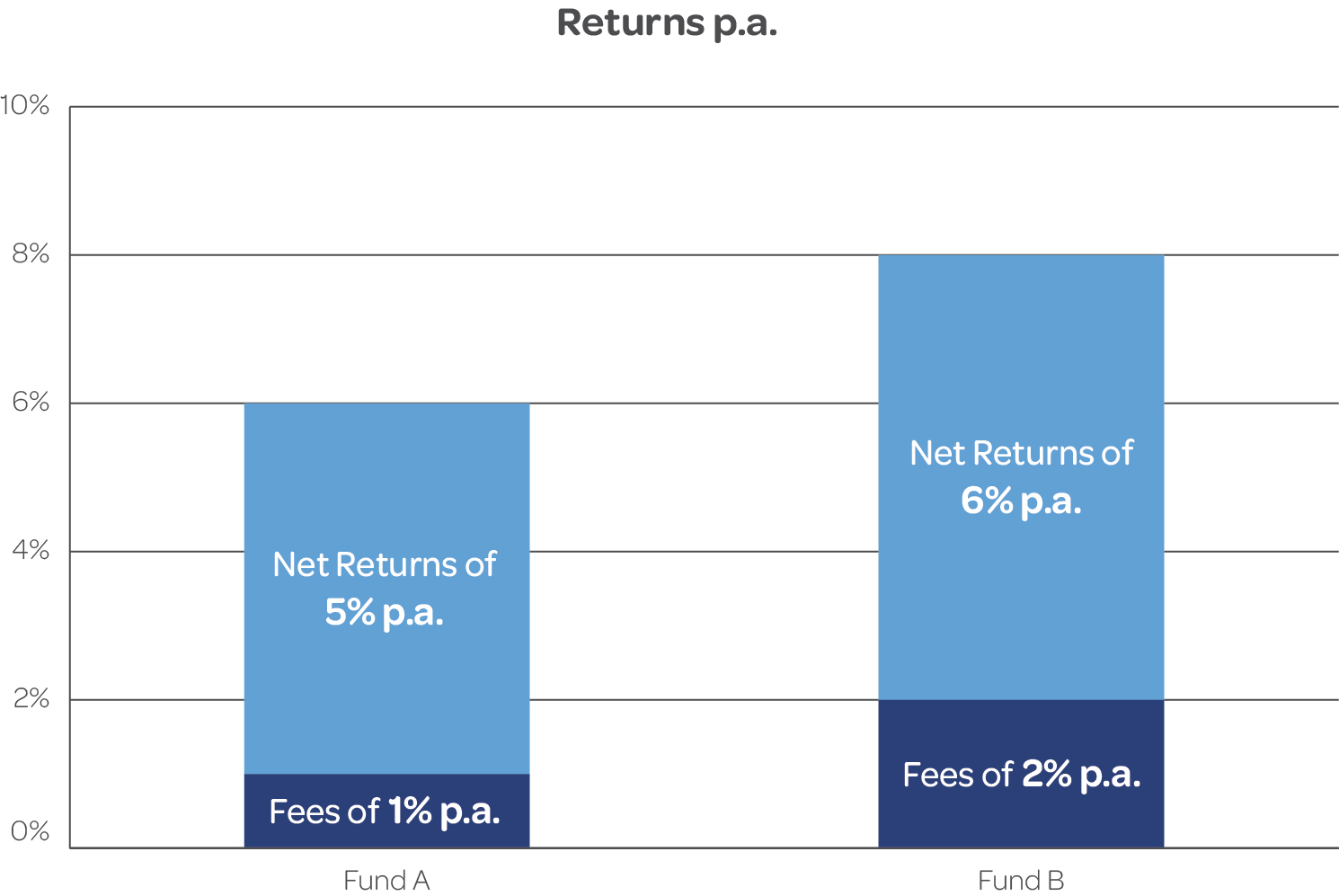

3. Don’t just focus on fees – always compare net returns, over the long term

It’s an easy mistake to make. You may have chosen your initial KiwiSaver Scheme provider because they said they charged lower fees.

But fees are only part of the story – to truly compare how well off you’d be with different KiwiSaver Scheme providers, you need to compare net returns. Net returns are the returns made on your investment, minus the fees you pay. This is the clearest measure of a fund’s performance.

That’s because a provider might have comparatively low fees, but not very good returns. Overall, that makes your investment worse value than if you paid slightly higher fees but gained greater returns.

It’s also key to look at long-term returns. Any KiwiSaver Scheme provider can tout coming 1st place in the last quarter or year, but long-term performance is what really matters. After all, you’re in KiwiSaver for the long haul.

At Generate we’re proud that our 10-year returns are consistently some of the best in the business - and that doesn’t vary very much, quarter by quarter.

If you’re not a maths whizz, it can be a hassle to figure out all the data and subtract fees from long-term returns. It’s always a great idea to chat with a Generate KiwiSaver Scheme adviser who can compile this information for you.

TO DO

✔ If you have worked out that your current provider isn’t giving you the long-term net returns that you want, it’s simple to switch to a different provider – the choice is always in your hands. It takes just a few minutes online and all you need is a driver’s licence or passport. If you prefer, you can always talk to one of our friendly Generate KiwiSaver Scheme advisers – they can show you our long-term returns and answer any questions you may have, with a no-obligation chat in person or online.

✔ You can also head to the Morningstar website and see all the KiwiSaver Scheme providers’ returns for yourself.

4. When it comes to your KiwiSaver account, don’t set it and forget it. Get expert advice along the way.

Even though your KiwiSaver investment is for the long term, there are still lots of points along the journey for everyone. You might be thinking about a first-home withdrawal, your employment status might change or you might even work in Australia for a few years. Our friendly Generate KiwiSaver Scheme advisers can help you every step of the way, to make sure you are investing in the right fund, getting all the benefits you’re entitled to and are on track for the best possible financial future.

Checking in with a Generate KiwiSaver Scheme adviser is a smart yet simple way to ensure you get the most from your investment. Contact us for a no-obligation chat, online or in person.

TO DO

✔ Book your no-obligation chat today.

✔ If you find it valuable (many of our members do), you can also book an ongoing annual appointment. *With this ongoing service, please note that some advisers may charge an additional fee, as a percentage of your investment returns.

That's a wrap for our 4 KiwiSaver hacks to help you start 2025 on track! We hope you found them useful and you're now inspired to take control of your financial future.